The average manufacturing overhead cost per unit tends to – As the average manufacturing overhead cost per unit takes center stage, this analysis delves into its intricacies, shedding light on its impact, allocation methods, influencing factors, and strategies for reduction. Prepare to embark on a journey of knowledge and discovery as we unravel the complexities of this crucial aspect of manufacturing.

Manufacturing Overhead Cost Components: The Average Manufacturing Overhead Cost Per Unit Tends To

Manufacturing overhead costs are those indirect costs incurred in the production process that cannot be directly assigned to a specific unit of output. These costs are allocated to units based on various methods, such as direct labor hours, machine hours, or production volume.

Types of Manufacturing Overhead Costs

- Indirect Labor:Wages and benefits of factory workers who are not directly involved in production, such as supervisors, maintenance personnel, and quality control inspectors.

- Utilities:Electricity, gas, water, and other utilities used in the manufacturing process.

- Depreciation:Allocation of the cost of factory equipment and buildings over their useful lives.

- Property Taxes and Insurance:Taxes and insurance premiums related to the factory building and equipment.

- Factory Rent:Rent or lease payments for the factory space.

- Supplies:Consumable items used in the production process, such as lubricants, cleaning supplies, and packaging materials.

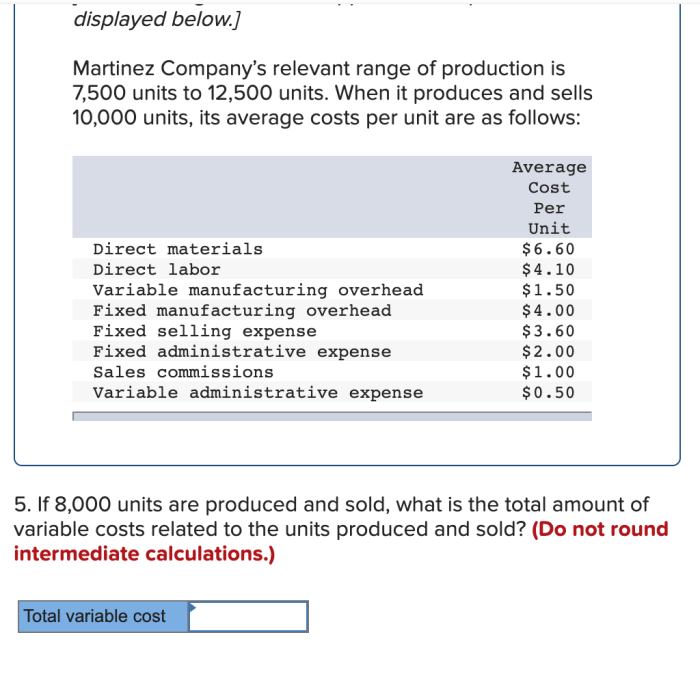

Impact of Volume on Overhead Cost per Unit, The average manufacturing overhead cost per unit tends to

The volume of production affects the allocation of overhead costs to individual units. As production volume increases, the fixed overhead costs are spread over a larger number of units, resulting in a lower average overhead cost per unit. Conversely, as production volume decreases, the fixed overhead costs are spread over a smaller number of units, leading to a higher average overhead cost per unit.

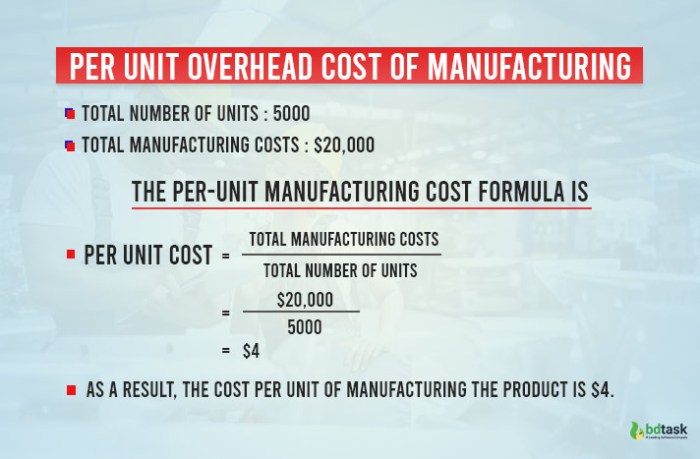

Formula for Average Manufacturing Overhead Cost per Unit:

Total Manufacturing Overhead Cost / Number of Units Produced

Example:

If a company incurs $100,000 in manufacturing overhead costs and produces 10,000 units, the average manufacturing overhead cost per unit is $10 ($100,000 / 10,000).

Methods for Allocating Overhead Costs

There are several methods used to allocate overhead costs to units. The most common methods include:

- Direct Labor Hours:Overhead costs are allocated based on the number of direct labor hours worked on each unit.

- Machine Hours:Overhead costs are allocated based on the number of machine hours used to produce each unit.

- Production Volume:Overhead costs are allocated based on the number of units produced.

Each method has its advantages and disadvantages, and the choice of method depends on the specific circumstances of the company.

Factors Influencing Overhead Cost per Unit

The average manufacturing overhead cost per unit is influenced by several factors, including:

- Production Volume:As discussed earlier, production volume affects the allocation of overhead costs to units.

- Product Mix:The mix of products produced can affect the overhead cost per unit, as different products may require different amounts of overhead resources.

- Manufacturing Process:The efficiency of the manufacturing process can impact the overhead cost per unit. A more efficient process will result in lower overhead costs.

- Overhead Cost Structure:The proportion of fixed and variable overhead costs can affect the overhead cost per unit. A higher proportion of fixed costs will result in a higher overhead cost per unit at lower production volumes.

Strategies for Reducing Overhead Cost per Unit

There are several strategies that companies can implement to reduce manufacturing overhead costs per unit, including:

- Improving Production Efficiency:By streamlining the manufacturing process and reducing waste, companies can reduce the amount of overhead resources required per unit.

- Outsourcing Non-Core Activities:Outsourcing non-core activities, such as maintenance or cleaning, can reduce overhead costs.

- Negotiating with Suppliers:Negotiating lower prices with suppliers can reduce the cost of materials and supplies, which can in turn reduce overhead costs.

- Implementing Lean Manufacturing Principles:Lean manufacturing principles focus on eliminating waste and improving efficiency, which can lead to reduced overhead costs.

Key Questions Answered

What are the key components of manufacturing overhead cost?

Manufacturing overhead cost encompasses indirect costs such as rent, utilities, depreciation, insurance, and administrative expenses.

How does production volume affect the overhead cost per unit?

Higher production volume leads to a lower overhead cost per unit as fixed overhead costs are spread across a greater number of units.

What are the advantages and disadvantages of different overhead allocation methods?

Common methods include direct labor hours, machine hours, and activity-based costing, each with its own advantages and limitations in terms of accuracy and simplicity.